reit tax benefits uk

While REITs are tax-efficient for investors using ISAs or SIPPs investments in REITs outside of these accounts could incur large tax bills. Taxation Of Reits Ringing In The Changes A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen.

Nps Vs Ppf Which Is Better Personal Finance Plan Personal Finance Finance Plan Income Investing

Market capitalization weighted indicies designed by Wachovia to measure the performance of the US.

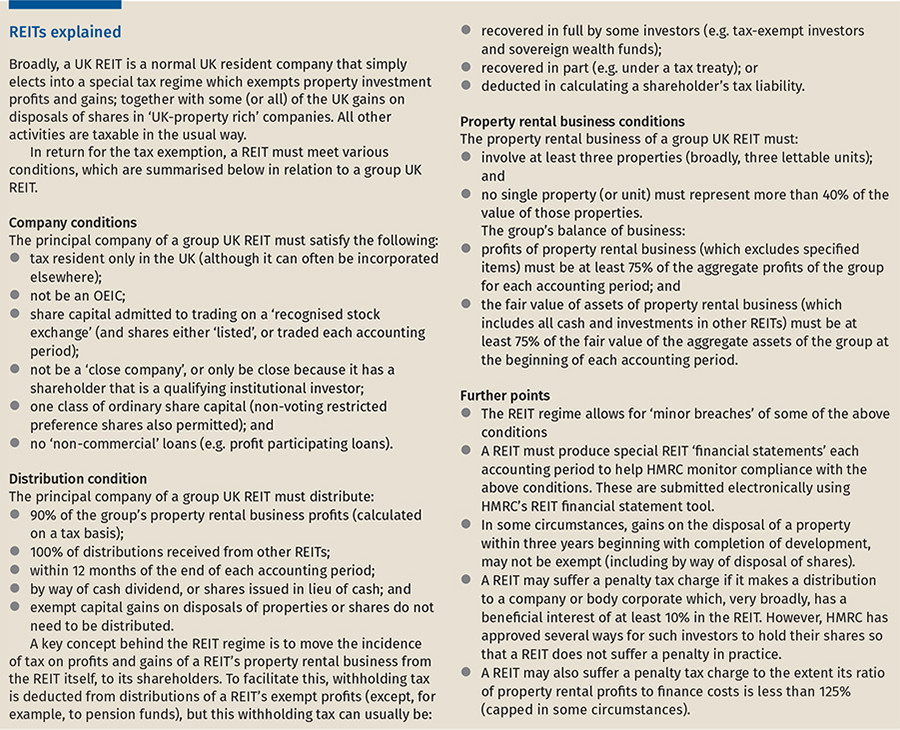

. A REIT is exempt from corporation tax on both rental income and gains on sales of investment properties and shares in property investment companies used in a property rental business carried on in the UK. REITs are quoted companies or groups of companies that own and manage property whether that is commercial or residential with the aim of generating a rental income. REIT status affords a number of commercial and tax benefits including.

The Government has made the REIT regime more attractive with the changes to the legislation in recent years. In such cases the company is considered as resident under provisions of the tax treaty. Clearstream Banking provides these rates for information purposes only and does not guarantee that this information is correct complete and accurate.

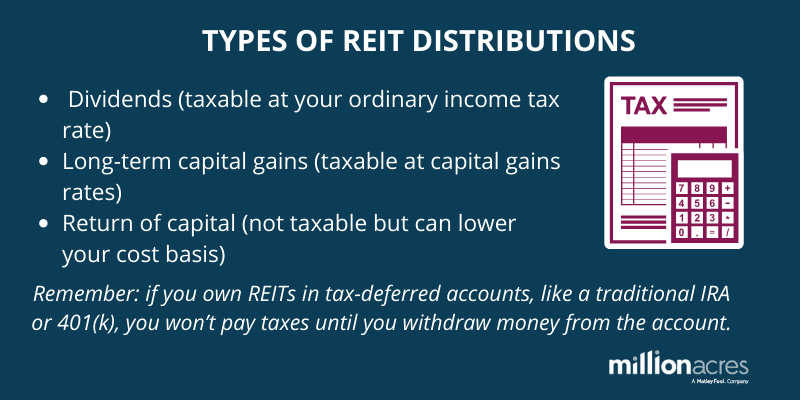

Distributions from the PRB in the hands of investors are taxed as a PID and distributions from the residual business are taxed as ordinary dividends in the normal way. Property investment becoming more accessible and desirable for all types of investors from pension funds who would be attracted by the regular cash flow to the man on the street who would be able to hold a liquid interest in large commercial property. Reit tax benefits uk Saturday February 26 2022 Edit.

Where the UK-REIT satisfies the relevant conditions its rental income is exempt from corporation tax as are capital gains on the disposal of rental properties. If it pays a dividend to shareholders thats after-tax. This relaxation will provide a further vehicle for joint.

Ad Invest In A Diversified Portfolio Of Real Estate Investments Across The Us With Fundrise. Investing in REITs via an ISA. How Is Reit Income Taxed Uk.

Preferred shares in addition to five. A real estate investment trust REIT is exempt from corporation tax on qualifying rental income and gains on sales of investment properties and shares in property investment companies used in its UK property rental business. REITs are eligible ISA investments - so if you buy a REIT via an ISA neither you or the company pays any tax.

Property rental business Property rental business profits and gains are tax-exempt within the REIT itself. The income from a REIT investing in another UK REIT is treated as income of the investing REITs tax exempt property rental business provided the investing REIT distributes to its investors 100 of the property income distribution it receives from investing in another REIT. A potentially high tax bill.

Your REIT Income Only Gets Taxed Once When a typical corporation makes money it has to pay taxes on its profits. Though even that tax can be avoided. This is particularly true for those who pay higher- or additional-rate Income Tax reducing profits by as much as 40 or 45 respectively.

Tax charges can arise if any of the conditions for qualifying for REIT status are breached although. A Real Estate Investment Trust REIT is exempt from UK tax on the income and gains of its property rental business. A high distribution requirement also protects the UK tax base because the point of taxation for a UK REIT is in the hands of investors where distributions may be subject to withholding tax at 20.

Taxation of a UK REIT A UK REIT needs to carry on a property rental business and meet the various conditions for REIT status. Access to the global REIT brand. Wachovia Hybrid and Preferred Securities WHPPSM Indicies.

The pass-through deduction allows REIT investors to deduct up to 20 of their dividends. However despite greater cost and complexity private REITs may produce significantly better after-tax results in the right circumstances. All UK residents receive an annual ISA allowance 20000 in 201819.

REIT Tax Benefits No. A REIT or Real Estate Investment Trust is a specialist tax efficient investment vehicle built around real property assets and more specifically property rental activities. For example the France UK tax treaty allows REITs to benefit from its provisions even if they are expressly excluded under withholding tax rules.

As long as the business does not engage in activities that interfere with its other activities its other activities fall under corporation tax. Limited partnerships and limited liability companies are generally the preferred vehicles for private investment in real estate due to their flexibility low cost and tax efficiency. Shares bought via an ISA are shielded from tax on both the dividends received and any capital gains on sale.

As at October 2018 there are c75 UK REITs. Clearstream Banking does not assume liability for any damages direct or indirect that may arise from the reliance on or the. Thanks to the 2017 Tax Cuts and Jobs Act sweeping new changes to the tax code allow for a lucrative tax benefit for REIT investors.

REITs - Property Income Dividends - Double Taxation Treaties concluded by UK and currently in force. A REIT investor REIT can now invest in another REIT target REIT without a tax penalty so long as the investor REIT distributes to its shareholders the whole of the rental distribution received from the target REIT. This article provides a brief overview of REIT.

This allows it to benefit from exemptions from UK corporation tax on profits and gains arising from its property rental business. This includes publically traded REITs generally listed or traded on the London Stock Exchange as well as institutionally owned REITs generally listed on The International Stock Exchange. Furthermore a REIT is able to benefit from a rebasing of underlying property assets when it acquires a company owning property investments meaning that the target.

First the tax treaty can expressly mention the REITs as beneficiaries of the provisions of the tax treaty. An advantage of the regime is that qualified property rental businesses subject to the REIT tax benefit are not subject to UK corporation tax. Over 160 Million Net Dividends Earned By Investors Since 2014.

The anticipated advantages of a UK REIT include the following.

Financial Professional On Instagram What Are Your Thoughts On Real Estate Investing Do You Prefer Other As Investing Real Estate Investing Finance Investing

How Income Tax Rules Help Reit Investors Earn More In Long Term Mint

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Profit Sharing Plan For Small Businesses And High Income Earner How To Plan How To Motivate Employees Successful Business Owner

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Difference Between Epf And Ppf Income Investing Investing Basic

Maverick Has A Snazzy New Infographic That Walks You Through The 10 Basic Steps Of Buying Investment P Investment Property Investing Buying Investment Property

Real Estate Investment Trusts How To Build Your Own Reit Portfolio Real Estate Investment Trust Real Estate Investing Real Estate Investing Books

Is Homeownership Becoming Less Stressful Dsnews Colorado Springs Real Estate Real Estate Investment Fund Real Estate Funds

Taxation Of Reits Ringing In The Changes

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Growth Reit Diversyfund Investing How To Buy Land Real Estate Investment Trust

Conversable Economist What Should Be Included In Income Inequality Income Inequality C Corporation

Crct Posts 8 5 Decline In 4q Dpu To 2 37 Cents On Additional Tax Provision And Forex Losses Crct Trust Forex

Reit Dividends And Uk Tax Assura

How Are Reits Taxed Millionacres

Dyman Real Estate How To Use Crowdfunding To Invest In Real Estate It S The Facebook Approach To Money Connect Real Estate Investing Crowdfunding Investing

Weekly Roundup 28th October 2015 7 Circles Stamp Duty Personal Finance Finance